Hur mycket tillväxtmarknad man bör ha är inte helt lätt. Men korta svaret är att de flesta har för lite.

https://www.morganstanley.com/im/en-us/financial-advisor/insights/articles/emerging-market-allocations-how-much-to-own.html

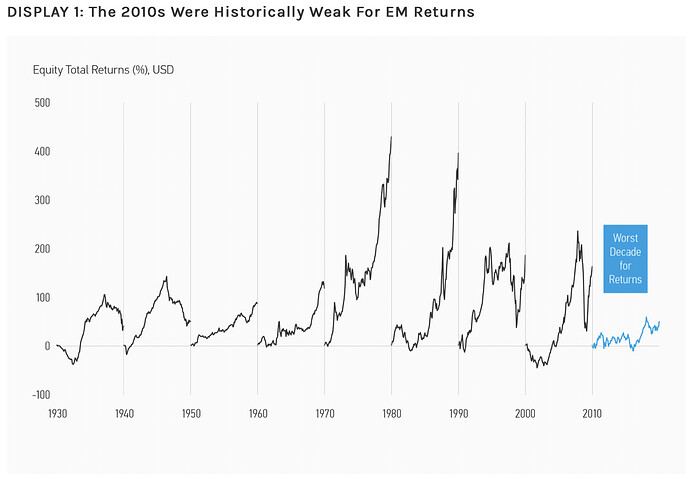

Lätt att strunta i EM eftersom det gått dåligt på sistone, men det är snarare ett undantag än en regel:

De föreslår högre andel än vad de flesta portföljer har (jämför beige mot blå):

It would appear then, that most global equity portfolios, no matter how sophisticated, are still guilty of home bias. For decades, they have been missing an opportunity to earn higher risk-adjusted returns by allocating too low a share of their portfolios to international equity. We think their EM allocations are still too low. The analysis above suggests that the typical EM allocation is at most about half, and perhaps as little as one sixth, of what a rational approach would recommend. […] In general, we think the logical answer to “how much” to invest in emerging markets is more. For a host of fundamental and structural reasons, that answer has rarely been more true than it is right now.