Research paper från Goldman “Investing in Everything, Everywhere, All at Once”

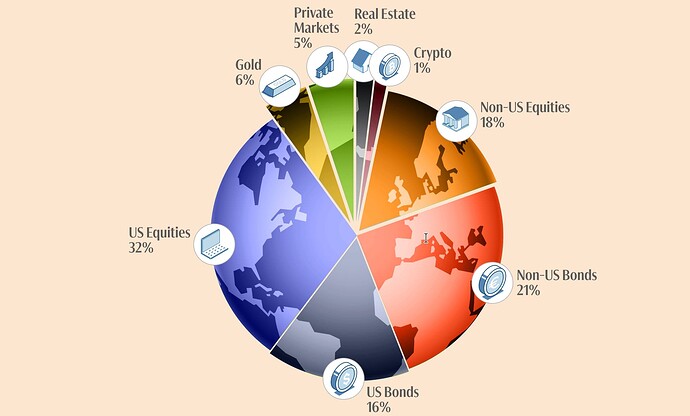

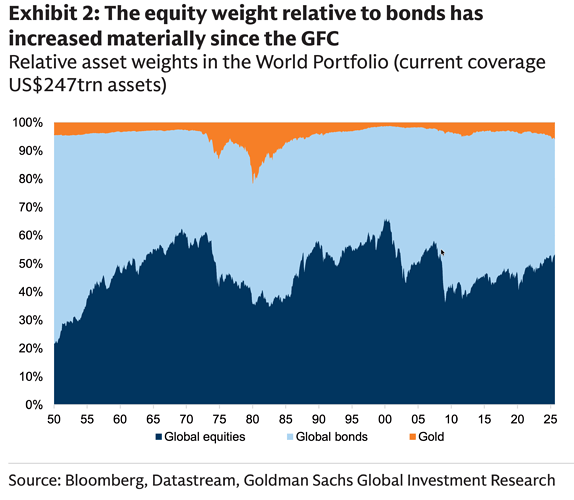

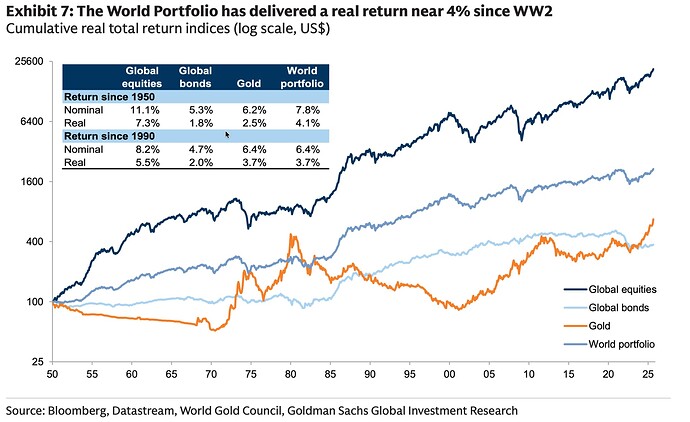

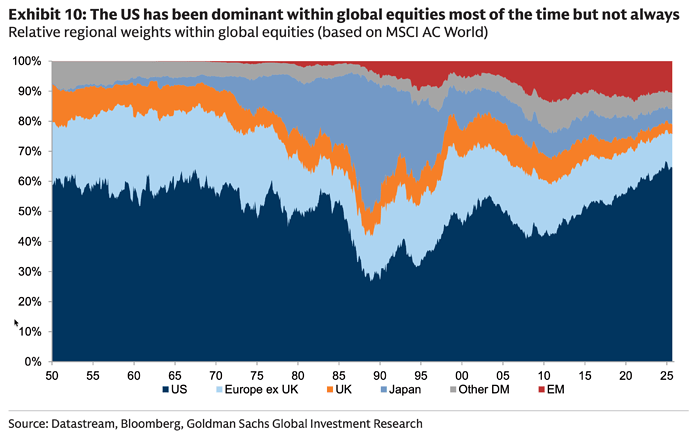

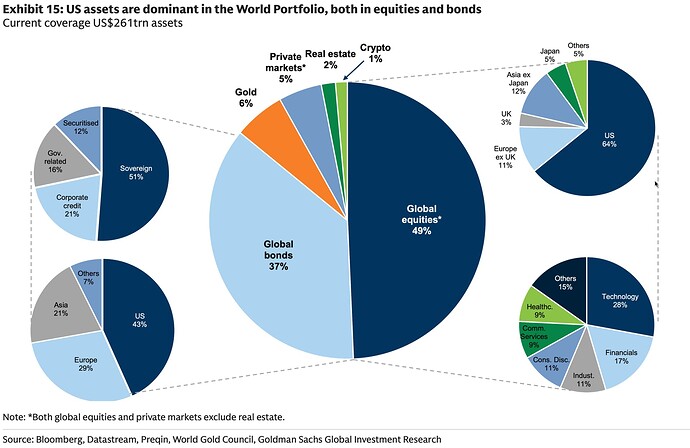

The World Portfolio is the sum of all assets globally. It can be a useful benchmark for multi-asset portfolio performance and investor asset allocations. The sizes of assets in the World Portfolio indicate liquidity and importance in investor portfolios. Persistent shifts in asset weights are often closely linked to macro regimes.

Några intressanta grafer

Record high investor equity allocations mirror the World Portfolio According to the famous Capital Asset Pricing Model (CAPM)2, in equilibrium the World Portfolio is optimal. The idea of market efficiency (coupled with lower fees and mixed performance of active managers) has supported the growth in passive investing based on benchmarks in the last 25 years – more than half of assets under management in equity funds are now passive. In practice the World Portfolio also guides strategic asset allocation as asset sizes condition liquidity of investment opportunities.

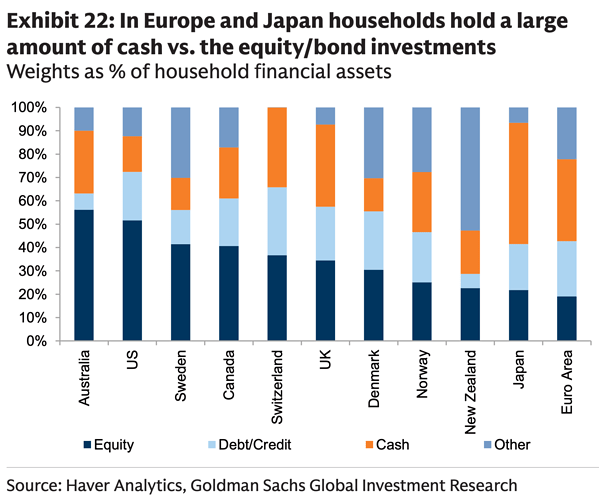

In a lot of countries, households hold fewer equities than the share in the world portfolio. The highest allocations are in the US, Australia, and Sweden