Trillade över en ny studie (juli 2024) som tittade på att investera i rätt andel i en portfölj bestående av alla världens tillgångar, typ en “global asset portfolio”. För mig är detta lite allmänbildning att se t.ex. fördelningen aktier vs räntor.

Ping @Andre_Granstrom, @Zino och några av er andra som också gillar titta på sådanan här studier. ![]()

Abstract

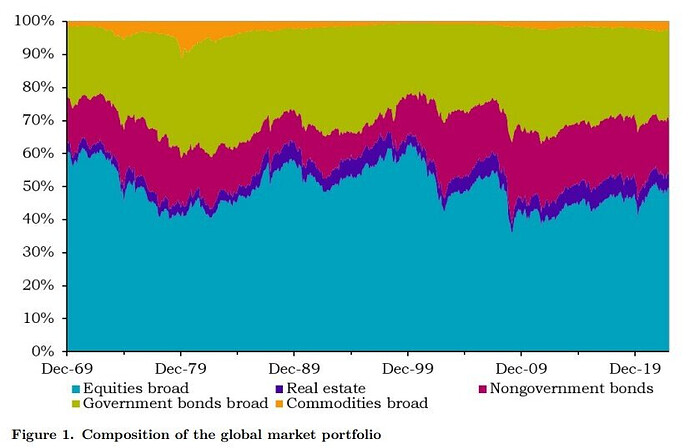

We examine the risks and rewards of investing by constructing a comprehensive market portfolio valued at $150 trillion in global assets and spanning 1970–2022 at a monthly frequency. The monthly frequency allows for a more accurate estimation of investment risks compared with previous studies. Even though the Sharpe ratio of the global market portfolio is not much higher than that of equities, it is much more stable over time. Moreover, drawdowns of the global market portfolio are less deep and shorter. When the market portfolio is expressed in currencies other than the U.S. dollar, risks of investing appear larger.

Källa: Doeswijk, Ronald Q. and Swinkels, Laurens, The Risk and Reward of Investing (October 15, 2024). SSRN,