Från Ben Carlson häromdagen “What Returns Should You Expect in the Stock Market? - A Wealth of Common Sense”.

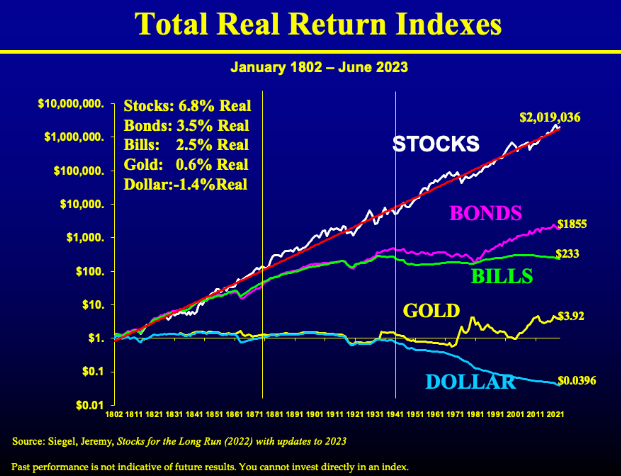

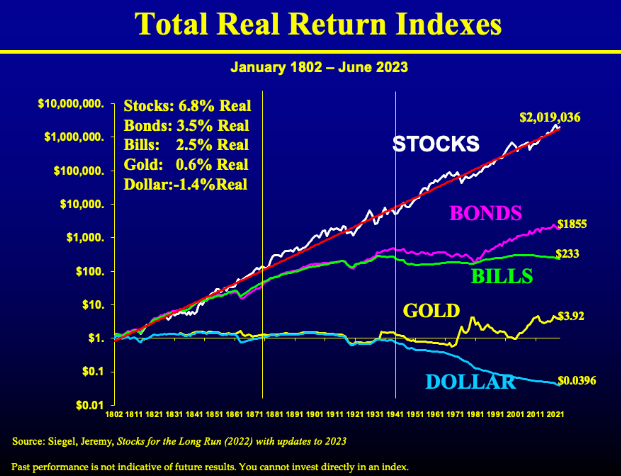

Here are some updated long-term inflation-adjusted returns for stocks, bonds, cash, gold and the dollar going back more than 200 years from Stocks For the Long Run by Jeremy Siegel and Jeremy Schwartz:

samt

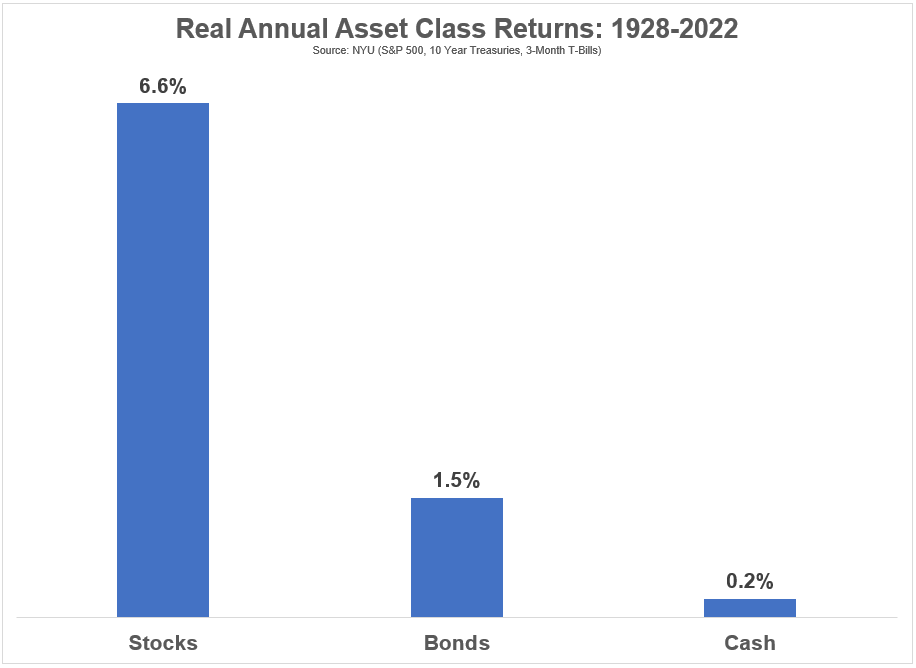

Aswath Damodaran has annual data for stocks, bonds and cash going back to 1928. Here are the real returns for those three asset classes over that time frame:

och

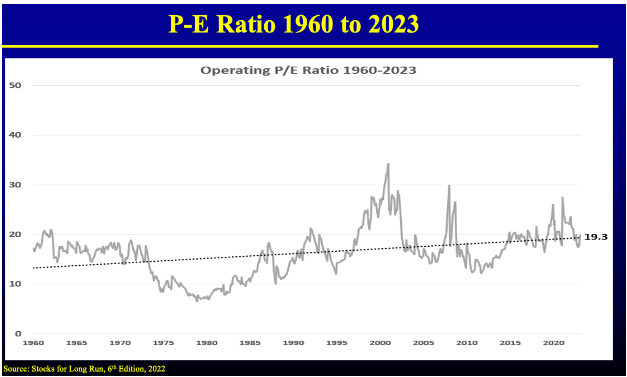

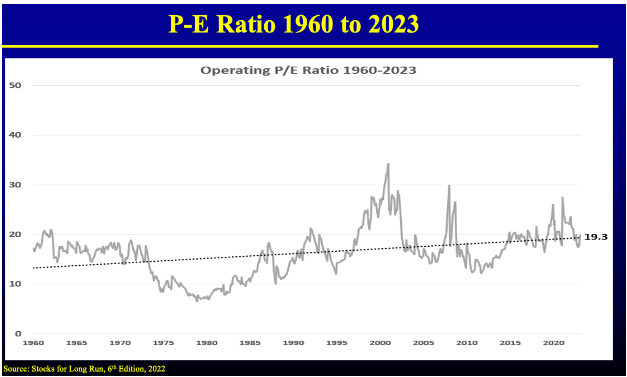

I guess what I’m trying to say here is you’re best bet is probably to use a range of real returns to set expectations for the future of your portfolio. I would say somewhere in the range of 5-6% real is reasonable based on current valuation levels:

The earnings yield is the inverse of the P/E ratio, which currently stands at around 5.2%.2

If things are better than expected you can adjust your plan accordingly.

If things are worse than expected you can adjust your plan accordingly.

1 gillning

Från en annan Ben Carlson-artikel:

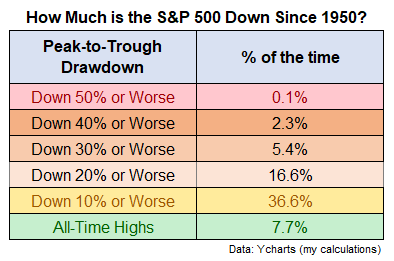

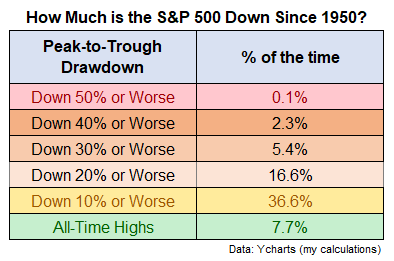

I looked at the daily returns on the S&P 500 going back to 1950 to see how often the market was in a state of drawdown at different levels of losses:

We’ve had 40% and 50% crashes but it’s pretty rare. You don’t spend all that much time there as an investor. Sometimes you’re going to get your face ripped off in the markets and learn to live with it but you can’t shouldn’t expect it to happen all the time.

The market has been in a bear market (down 20% or worse) nearly 17% of the time. That’s more than double the amount of time we’ve spent at new all-time highs over the past 75 years or so.

In fact, the average drawdown from all-time highs for the S&P since 1950 is close to 10%.

och

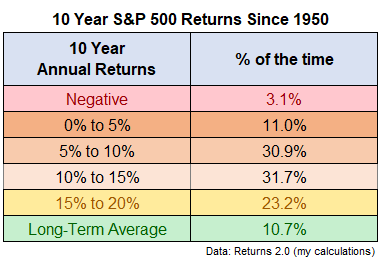

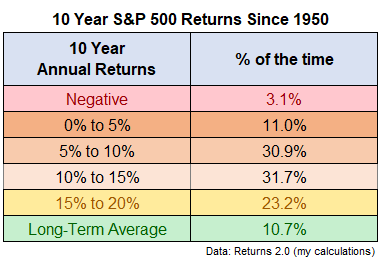

I looked at the rolling 10 year returns for the S&P 500 going back to 1950 to find the distribution of annual returns at various levels:

More than 3% of the time returns have been negative over 10 year time frames. Annual returns have been 5% or worse 14.1% of the time. That’s not great.

However, annual returns have been 10% or higher 55% of the time. Annual returns of 8% or more have occurred in nearly 70% of all rolling 10 year windows since 1950.

Most of the time good things happen in the markets but sometimes bad things happen.

2 gillningar