Jared Dillian vars nyhetsbrev jag följer postade häromdagen det här nyhetsbrevet med en rätt kul metafor (särskilt om man sett dokumentärserien The Last Dance på Netflix). Blir nästan alltid fascinerad av att aktieandelen är så pass låg när de flesta ligger på långt över 50 % aktie-exponering.

How to Get the Dennis Rodman Effect

Dennis Rodman is one of the greatest basketball players of all time, but you would never know it by looking at his numbers.

He averaged 7.3 points per game in his professional career, making him the lowest-scoring inductee in the NBA Hall of Fame.

If you were a general manager in the 1990s, looking to build an aggressive, high-scoring team, you might have passed him over. His stats were weak (and his extracurriculars were sketchy).

- But every team needs a Dennis Rodman.

He was a great rebounder and defender. When he played with four other guys who could score, he helped them perform better. Just ask Michael Jordan.

Rodman played on five NBA championship teams, including the 1995–96 Chicago Bulls team. It’s widely considered the best team ever.

- Your investment portfolio needs a Dennis Rodman.

Apple (AAPL) is a great stock. But if you only own Apple-like stocks, you’re exposing yourself to too much risk.

Yet that’s what people do. They stuff their portfolios full of stocks like Apple, Amazon (AMZN), and Tesla (TSLA), and call it a day.

There are so many things wrong with that approach. The big one is… they’re all stocks .

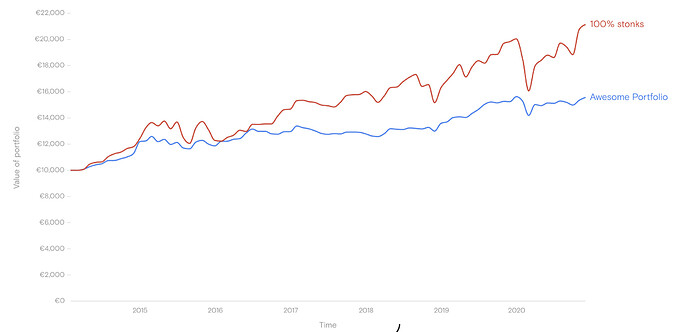

Longtime readers know you want to spread your investments across various types of assets. It’s called diversification. And it’s the best way to steadily grow your wealth over time.

It’s also how you limit your risk of losing money and lower your portfolio’s volatility—meaning its tendency to experience wild, rapid swings.

- This is how it works…

When you set up your investment portfolio, instead of buying all stocks, spread it out over:

- 20% stocks

- 20% bonds

- 20% cash

- 20% gold

- 20% real estate

This setup—I call it The Awesome Portfolio—works because when one member of the team takes a dip, the others pick up the slack.

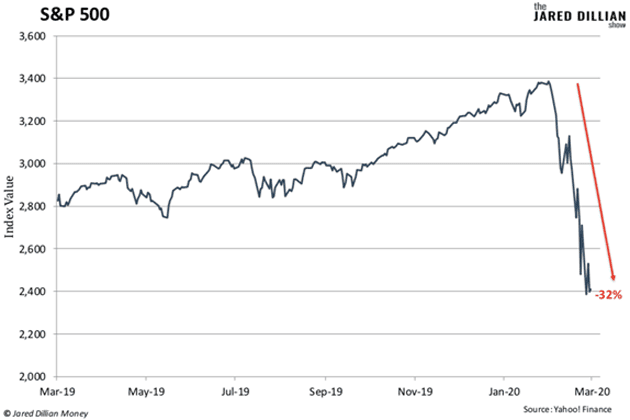

Let me walk you through an example. Think back to March 2020, when coronavirus fears kicked into high gear. Investors panicked, and stocks plummeted 32%.

If all of your money was tied up in stocks, you had a really bad month.

Just a little bit of diversification would have limited your losses. Say you had 80% stocks and 20% bonds right before the crash. That would have limited your loss to 24%. Still not great, but better .

Now, if your portfolio was set up the way I showed you earlier, with 20% stocks, 20% bonds, 20% cash, 20% gold, and 20% real estate, you would have taken a much more manageable 16% hit. So, you would have been much more likely to hold on for the recovery that followed.

- Building an Awesome Portfolio is easier than you might think.

People generally get the stock and bond components of The Awesome Portfolio and buying gold.

Then they read “real estate” and feel a bit intimidated. They think they need to buy an apartment complex, find some tenants, and start collecting rent. That is not realistic or even desirable for most people.

Most people are better off putting some money in a real estate investment trust (REIT).

REITs are a special type of business entity that own various kinds of real estate—everything from hospitals to hotels. Then they turn around and lease that space to bring in income.

REITs also trade just like stocks, so you can invest in a REIT through an ordinary brokerage account. It’s as simple as buying shares of Walmart (WMT) or Coca-Cola (KO).

- You don’t have to do anything complicated…

That’s the beauty of The Awesome Portfolio. You could build a championship team—Dennis Rodman included—right now.