Jag återanvänder en text jag skrev i ett annat sammanhang:

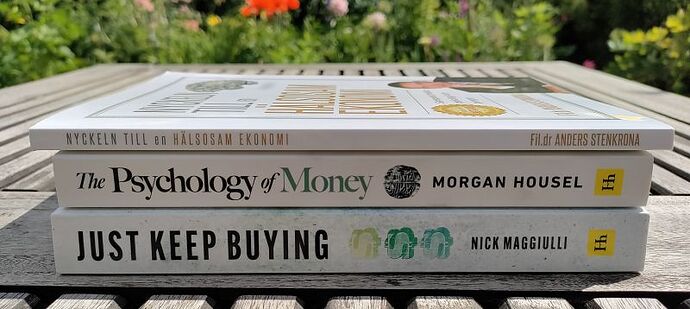

Recently I have read three great books on personal finance and investing. I have read many books on the subject in the past, so I know the standard advice, like invest regularly in index funds, pay yourself first etc.

Still, sometimes it is good to remind yourself of the basics. But these three books also added some interesting angles that were somewhat new to me. So here are three book recommendations for your summer reading (all are quick reads):

The first book is by Anders Stenkrona. It is called “Insider Secrets to Financial Well-Being” (“Nyckeln till en hälsosam ekonomi” in Swedish). Here I particularly liked chapters 3 and 4.

Chapter 3 talks about psychological reasons why it is hard to follow investment advice. There are 3 main reasons: it takes effort, we are loss-averse, and it is easier to focus on the moment, rather than the future. There are good explanations of how and why this happens, with references to research papers.

Chapter 4 is also very good. It discusses how to get the most happiness out of money. The 4 keys are: spend on experiences rather than things, spending money on others brings more joy than spending on yourself, several small pleasures are better than a few big ones, and finally looking forward to something brings you joy for free.

The second book is “Just Keep Buying” by Nick Maggiulli. This is what I like the most in that one:

-

You may not need to save as much as you think, if you sell down principal in retirement (instead of just using the returns of the investments – which is what most retirees do)

-

Focus on increasing your income, rather than saving as much as possible of your current income. This is because there is a limit to how much it is possible to save (you still have to pay for food, housing etc), whereas there is no limit (at least in theory) on how much you can increase your income. For most people, the easiest way to do this is to climb the corporate ladder (that is, finding progressively better-paying roles).

-

It is generally better to invest available money right away, rather than averaging-in over time. This is because most stock markets go up most of the time.

-

Don’t sit on money to buy the dip – being invested in the market gives better results, even if you could perfectly predict when the bottom of the dip is (which you can’t).

-

You will never feel rich, since there are always people that are better off than you. Switch the perspective – there are tons of people worse off than you, so you are already rich.

The third book is “The Psychology of Money” by Morgan Housel. Two of the ideas from this book that I really liked are:

No One’s Crazy – people have very different experiences (of inflation, stock returns etc), and act rationally according to how they see the world.

You’ll Change – things change, both the world around you, and your own goals and desires. Therefore, avoid the extreme ends of financial planning.

Happy reading!