Fick tag på den här rapporten “Performance and Costs of EU Retail Investment Products - ESMA Annual Statistical Report 2021” från ESMA precis. Inte supermycket nytt eller oväntat. Men några saker som stack ut.

Citat:

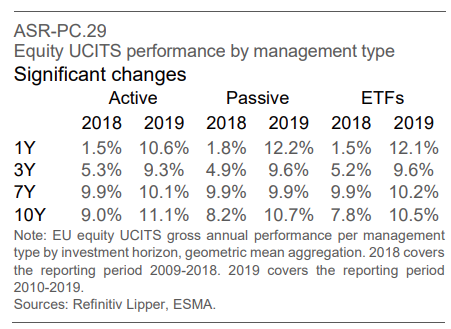

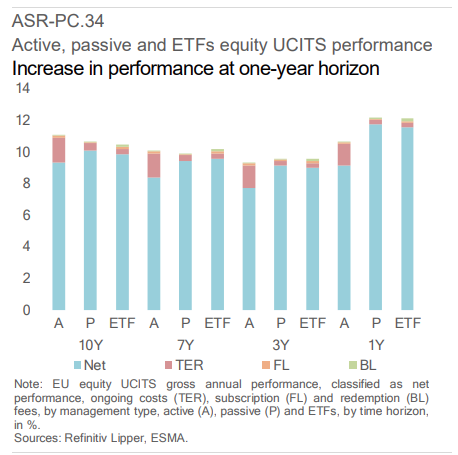

Table ASR-PC.29 reports gross annual performance across management types. In line with previous analysis, due to exceptionally strong equity performance in 2019, we can observe much higher gross performance over one-year horizon compared to the previous edition. Looking at management type, index tracking funds (12.2%) and ETFs (12.1%) outperformed in gross terms active funds (10.6%). This outperformance fades at the threeand seven-year horizons to then disappear at the ten-year horizon when active funds, with 11.1% outperformed passive (10.7%) and ETF (10.5%).

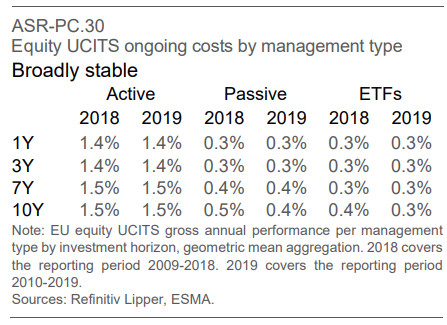

The picture changes when costs are considered. In particular, we focus the analysis on ongoing costs (Table ASR-PC.30).38 Ongoing costs remained broadly stable across reporting periods and investment horizons, and more than three times higher for active equity rather than passive and ETFs funds. This, in turn, implies that, if gross outperformance is not high enough, it does not compensate for the difference in costs across management types, leading to net underperformance for active funds.

A second key layer of analysis concerns the performance of actively and passively managed

equity and bond UCITS against their own prospectus benchmark (ASR-PC.42, ASRPC.43). Differently from the previous report, in 2019, actively managed equity UCITS outperformed on average their own benchmarks at ten-year and seven-year horizons, by less than a percentage point. After costs, the net annual performance was always lower for active UCITS, compared to their own benchmarks.

Positiva nyheter är att fondavgifterna i Sverige är relativt låga:

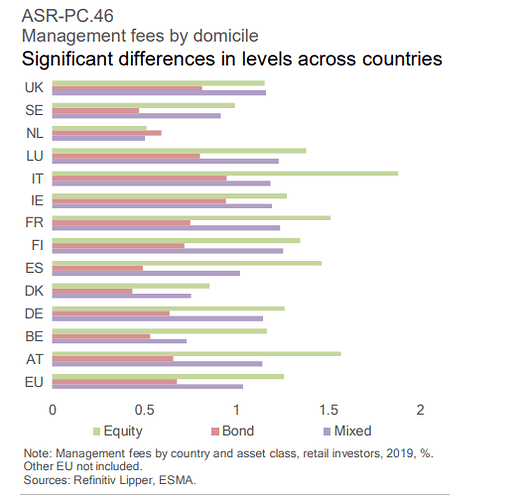

. Also, Denmark and Sweden had fees lower than the EU average. For equity, the highest fees were in France, Italy and Spain. For bond the highest fees were observed in Ireland

Samt:

- Costs were significantly higher for active UCITS compared to passive and UCITS ETFs, ultimately impacting performance.

- Net underperformance of active equity and bond UCITS, on average, compared to passive and UCITS ETFs.

- Outperformance of the top-25% active equity UCITS compared to the top-25% passive and related benchmarks, at shorter horizons. The cohort of UCITS changes over time, only 20% of the top performing equity UCITS at the end of 2019 was also top performing in 2018. This makes it complicated for investors to consistently identify outperforming UCITS.

- Slight net underperformance for the top-25% actively managed bond UCITS compared to passive on average across three- and one-year horizons

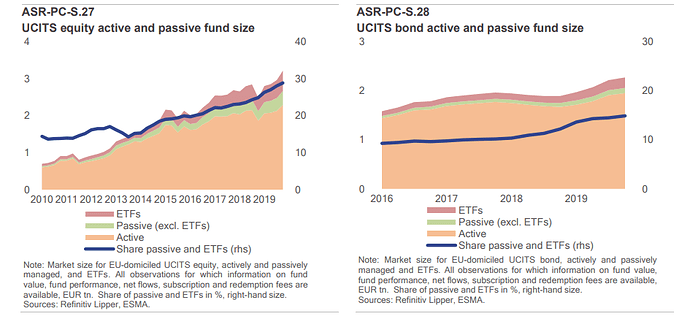

Risken att “alla investerar i indexfonder” ter sig inte vara jättestor än.