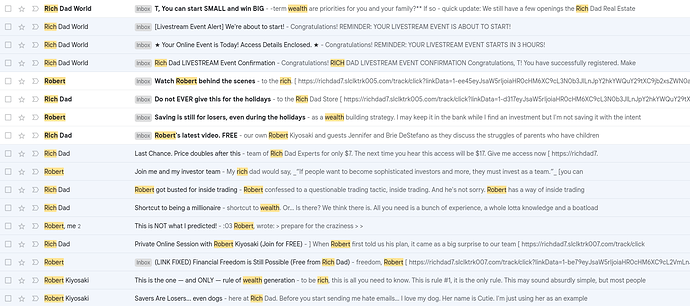

Här kommer innehållet i några av mailen.

Glömde säga att de hintar om gratistips först och sen börjar det luta mer och mer åt att man ska betala dem innan det blir mer kritiskt att passa på att köpa deras tjänster.

I have a dog. I don’t write much about her but she is the perfect example of why savers are losers… and how different we think about money here at Rich Dad.

Before you start sending me hate emails…

I love my dog. Her name is Cutie. I’m just using her as an example…

The other day I gave Cutie a treat. A dog bone.

She immediately ran to the back and started digging until she had enough of a hole to bury the bone.

It made me chuckle a little bit. She did it immediately. She did not even think about it. She was preprogrammed to save her bone.

I think people are the same way. We have been taught since birth to save our money. That saving money is the only way to retire someday.

Anyways, I took a closer look at the burial site of her new bone.

Nature had already begun attacking:

-

Ants were already there taking what they could off that bone.

-

As I backed up, I saw birds swooping down and start rummaging through the loose dirt.

-

As we learned in school, nature itself will start to eat the bone through bacteria, algae and other decomposing agents.

Cutie may have protected her bone from other dogs, but she did not realize that there were other forces stealing her bone from her. Forces she was either unaware of, never thought about or just could not see.

Cutie was slowly losing her bone and she did not even know it.

That same thing is happening to most people in this world. By saving their money, they are losing their money to economic forces.

Most people are like my poor dad.

My poor dad believed in saving money. “A dollar saved is a dollar earned,” he often said.

All his life he saved, not realizing that after 1971 his dollar was no longer money.

You see, in 1971 President Richard Nixon changed the rules of money. Prior to 1971, the U.S. dollar was real money linked to gold and silver, which is why the U.S. dollar was known as a silver certificate. After 1971, the U.S. dollar became a Federal Reserve Note – an IOU from the U.S. government.

An IOU is debt.

That same year, the U.S. dollar ceased being money and became a currency… it became a debt the U.S. taxpayers had to pay.

Now, almost 50 years later, inflation eats away at the value of our dollar. What one dollar used to be able to buy, now takes many. Since 1971, he U.S. dollar has lost 95% of its value when compared to gold. It’s like the ants eating Cutie’s bone.

Because the interest rates that banks pay you for saving money is lower than the inflation rate, your money is decomposing in the bank vaults. Every day your money is in the bank, it’s value is diminishing.

Taxes, now needed to pay off our debt, eat at your dollar, too. They are like the birds digging at the bone.

The idea of the 401(k)-retirement plan is the final straw.

It’s the bacteria and algae eating your savings. The majority of money earned in a 401(k)-retirement plan goes to the fund manager, not you. Generally, 80% of the money earned goes to the investment firms, and what makes it worse, they get paid even if the 401(k) loses money.

Who’s the loser now? It’s not the banks, the government, or the 401(k) managers…

It’s all designed to make savers, losers.

To Understanding the Truth About Money,

Robert Kiyosaki

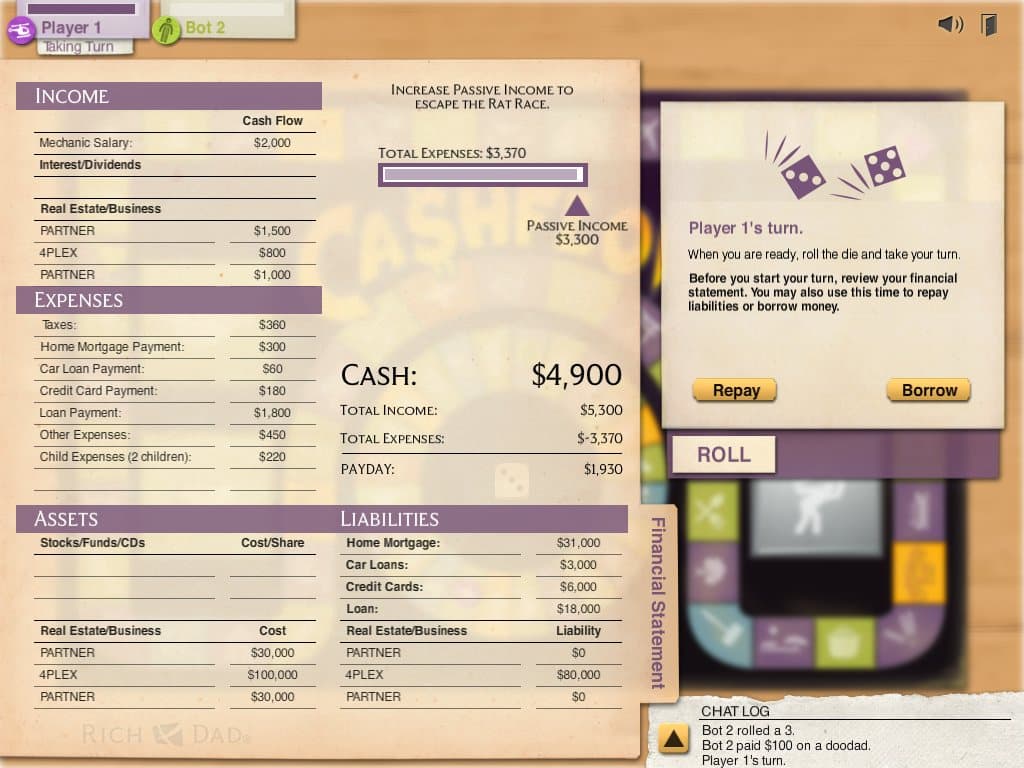

Rule #1: You must know the difference between an asset and a liability.

Then buy or create assets.

If you want to be rich, this is all you need to know.

This is rule #1, it is the only rule.

This may sound absurdly simple, but most people have no idea how profound this rule is.

Most people struggle financially because they do not know the difference between an asset and a liability.

An asset puts money IN your pocket. A liability takes money OUT of your pocket.

Here’s a question for you…

Is the home in which you live an asset or a liability?

In my view, your house is a liability. Even if you own the property with no mortgage, you still pay property taxes, utilities, insurance, maintenance, etc. Therefore: money is being taken out of your pocket.

Once you understand this simple rule… all you have to do is follow it to gain wealth.

To your wealth building,

Robert Kiyosaki

Listen, I’m only hearing one side of the story being told.

I see the news, I read the media, and I listen to other so-called financial experts. I think most of them have lost their mind and are not offering helpful information to you.

Yes, I know there are challenges facing investors. Inflation is a threat. The government’s changing policies are a threat. Fear of recession and a market crash are threats.

But where other people panic and say the sky is falling, [I see the other side of the story.]

I believe Financial Freedom is Still Possible for you!

Do you believe it?

To help you, I’ve asked my team to make available a free training that I provided a few months ago.

Unlike my other trainings, there are no special guests and long agendas, I wanted to do something different.

This online session is just you and me. I’ll tell you what I’m doing, how I got started, and why I’m confident you can do great things.

I see a time to change your focus. I see a time for courage and optimism.

If you are ready to cast a vision for a better future – I would recommend you watch the exclusive encore of my private session. [It’s 100% free for you, and I expect will be very helpful during these times.]

To achieving your financial freedom,

Robert

Everyone knows there is no shortcut to wealth.

Or…

Is there?

We think there is.

All you need is a bunch of experience, a whole lotta knowledge and a boatload of wisdom.

Wait! That is not a shortcut! But this is…

What if we gave you a team of over 20 wealth building experts? [ See the experts here ]

What if they could read the trends and translate them for you?

Or tell you what stocks to look into?

Or crypto?

Or strategies no one else knows?

Right now, while the world is crashing in around us…

While inflation is stealing your money…

While the government trains 87,000 new IRS agents…

We are giving you the greatest solution out there…

WEALTH!

Actually, you have to make your wealth, but we are going to give you the greatest team of experts in the world to show you how.

Simply click here and gain access to your private membership!

[ Give me access to my team of experts ]

Private Access,

Rich Dad Wealth Team

Here is a little taste of this month’s shortcuts,

Robert will be explaining the foundation needed to be rich

PLUS…

· You’ll learn a way to buy investments at an extra low price and then sell them at a higher price. This strategy happens once a year and its weeks away.

· The most likely actions the Federal Reserve will take in January. Will they raise interest rates? Will we sink into a recession?

· A way to earn up to 14% APY PASSIVE INCOME on and off exchange. 14%!!!

There is more:

· The Uranium market

· The Fed’s $50 BILLION dollar loss

· How to pay little or ZERO taxes even if you are not a big business like Apple or Amazon

[ Give me access to my team of experts ]

![]()

![]() ). Jag öppnade sidan på utsatt tid. En timer räknade ner till när det skulle starta. Man kunde skicka in frågor i ett formulär längst ner. Måste ju skriva en fråga och se hur det funkar! (~“Why do you hate taxes and the government?”)

). Jag öppnade sidan på utsatt tid. En timer räknade ner till när det skulle starta. Man kunde skicka in frågor i ett formulär längst ner. Måste ju skriva en fråga och se hur det funkar! (~“Why do you hate taxes and the government?”)

![]()

![]()

![]() . Orkade bara halvlyssna tre frågor.

. Orkade bara halvlyssna tre frågor.![]() .

.![]()

![]() , eller om det är barmhärtigast att avliva den

, eller om det är barmhärtigast att avliva den ![]() . Jag tar emot donationer till hårddisk-wipe-program.

. Jag tar emot donationer till hårddisk-wipe-program.![]()