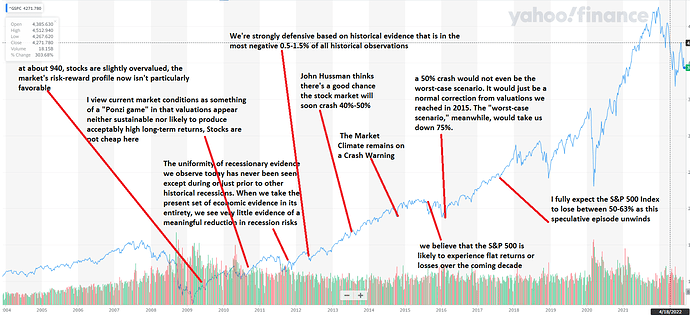

Min favorit-permabjörn John Hussman har återigen publicerat en ny tänkvärd artikel. Jag har dock lärt mig att inte agera på känslan “sälj alla aktier” varje gång jag läser hans analyser. Behållningen från hans text är att en nedgång på 50-70 % är fortfarande på bordet. ![]()

Några favorit-citat:

I can show, really precisely, that there are two warranted prices for a share. The one I prefer is based on such fundamentals as earnings and growth rates, but the bubble is rational in a certain sense. The expectation of growth produces the growth, which confirms the expectation; people will buy it because it went up. But once you are convinced that it is not growing anymore, nobody wants to hold a stock because it is overvalued. Everybody wants to get out and it collapses, beyond the fundamentals.

samt

What defines a bubble is that investors drive valuations higher without simultaneously adjusting expectations for returns lower. That is, investors extrapolate past returns based on price behavior, even though those expectations are inconsistent with the returns that would equate price with discounted cash flows. The defining feature of a bubble is inconsistency between expected returns based on price behavior and expected returns based on valuations.

samt

Along with those methods, I introduced our “Endowment/spending multiple,” which estimates the number of years of spending that a passive 60/30/10 investor requires up-front, in order to finance an expected 36-year stream of future inflation-adjusted spending. The idea here is that in a deeply undervalued market with high expected future returns, investors can finance a future stream of spending with far less than they require when valuations are extreme and prospective returns are low.

You know you’re in a bubble when funding a 36-year stream of expected inflation-adjusted spending requires over 38 years of money up-front.

och

Historically, investors wishing to match the duration of their investment portfolio to the duration of their investment horizon could be reasonably comfortable holding 100% of their assets in stocks, provided they had an investment horizon of about 25-30 years. Presently, these investors would need an investment horizon closer to 65-70 years. They are currently holding sippy cups.

Sedan känns det som att han har hängt i vår Bitcoin-tråd då han har gåvor även till @Guldfeber

Objects like tulip bulbs and Bitcoin differ from securities in that they do not deliver a stream of cash flows to the holder. Instead, what objects like tulips and currencies provide is a little stream of services over time, for example, as a perennial thing of beauty or as a means of payment. What people sometimes forget is that it is not just scarcity that defines the value of an object, but the stream of useful “services” that it provides (for some reason, nobody wants to buy my unique, limited edition, digitally-signed porcupine seat covers). The price of the object, and the stream of services it provides, should be commensurate.

samt

As I’ve noted before, blockchain is a brilliant algorithm, and I expect that it will have a great number of uses for secure transactions and inventory management. Bitcoin, however, is a token generated by an energy-inefficient, replicable blockchain app . Ultimately, its value rests on the capacity to provide transactions services, yet without fiat to require its use, and with strikingly narrow bandwidth – one block of roughly 2000 transactions every 10 minutes – that I expect will prove to be a wildly limiting feature. That’s a problem in in a world where speculators now value the stock of bitcoin at one-fifth the value of the entire U.S. monetary base.

Of course, Bitcoin may have a certain user base as a vehicle for money laundering and black market transactions, but that’s an undesirable investment thesis. The vast majority of transactions are to exchange Bitcoin itself, though the New York Times did recently report that “pornography, patio furniture, and an at-home coronavirus test are among the odd assortment of goods and services that people are purchasing with the cryptocurrency.” So, basically, if your typical day consists of surfing porn on your patio while testing yourself for COVID, you’re gonna want to look into Bitcoin.

![]()

![]()

. Vill inte att de ska färstöra min vardag

. Vill inte att de ska färstöra min vardag  . Man kan lika väl tänka så illa imorgon ska jag få stroke. Lika så kan jag drabbas av cancer eller hjärt infarkt. Lika lätt krocka med bilen . Oj vad jobbigt att leva ett negativt liv,utan hopp om framtiden och morgondagen.

. Man kan lika väl tänka så illa imorgon ska jag få stroke. Lika så kan jag drabbas av cancer eller hjärt infarkt. Lika lätt krocka med bilen . Oj vad jobbigt att leva ett negativt liv,utan hopp om framtiden och morgondagen.  . Livet blir mycket roligare om man tänker positivt och tror på det bästa . Det löser sig till slut

. Livet blir mycket roligare om man tänker positivt och tror på det bästa . Det löser sig till slut  .

.