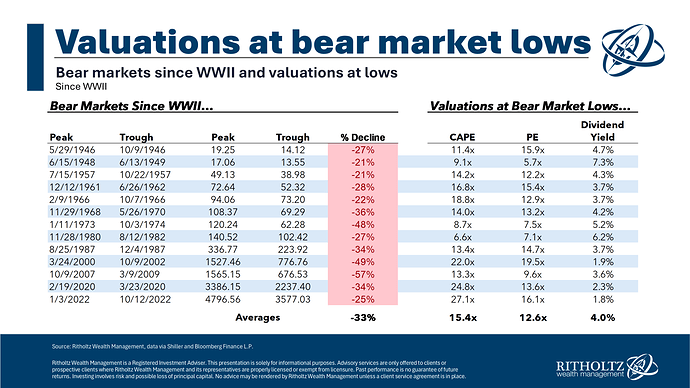

Från tid till annan kommer frågan om man inte kan tajma marknaden baserat på olika värderingsmått, där exempelvis CAPE är det mest kända. Ben Carlson kollade på det och tog fram följande bild:

Svaret är - föga förvånande - nej, det är inte supersmart.

Några citat:

The averages might look like solid entry points but averages can be deceiving when it comes to the stock market.

Three of the four bear markets this century didn’t see the CAPE ratio come close to previous bear market valuation levels. If your plan was to get more aggressive when the market got cheap enough, you would still be waiting.

The problem with using valuations as a timing indicator is that even if they do work on average, missing out on just one bull market can be devastating. You could be waiting a mighty long time to get back into the stock market and miss out on big gains in the meantime.

I’m not a big fan of market timing in general but if you really want to get more aggressive during a bear market, I prefer using pre-determined loss thresholds. For example, every time stocks are down 10%, 20%, 30%, etc., move a specified amount or allocation from bonds to stocks.

Angående det sista stycket: