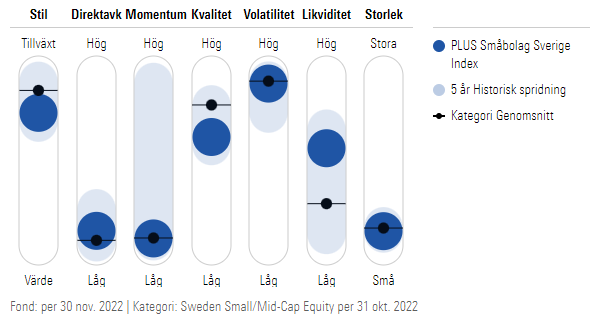

Kom över denna studien från 2015, och har funderat på på om det verkligen är värt att ha Småbolag indexfonder.

Conclusion

Size matters – and, in a much bigger way than previously thought – but only when controlling for junk. We examine seven empirical challenges that have been hurled at the size effect – that it is weak overall, has not worked out of sample and varies significantly through time, only works for extremes, only works in January, only works for market-price based measures of size, is subsumed by illiquidity, and is weak internationally – and systematically dismantle each one by controlling for a firm’s quality. The previous evidence on the variability of the size effect is largely due to the volatile performance of small, low quality “junky” firms.Controlling for junk, a much stronger and more stable size premium emerges that is robust across time, including those periods where the size effect seems to fail; monotonic in size and not concentrated in the extremes; robust across months of the year; robust across non-market price based measures of size; not subsumed by illiquidity premia; and robust internationally. These results are robust across a variety of quality measures as well.

We further find that interactions between size and other firm characteristics, such as value and momentum, can also be fully or partially explained by quality versus junk. Hence, the quality of a firm helps clean up the relation between size and the cross-section of expected returns.

This then begs the question why do average returns vary by the quality of a firm? Both riskbased and behavioral asset pricing theories should continue to try to explain this result. In particular, controlling for quality/junk significantly increases the Sharpe ratio of a size-based strategy, which poses a greater challenge for rational models (e.g., Hansen and Jagannathan (1997)).

Note we find that after controlling for the riskiest small, junk firms, the size premium gets stronger rather than weaker, which seems opposite to most risk-based stories for size. Our results show that a size effect that is net longer higher quality and less long junk, and for that matter less negative on liquidity measures, does far better. This will pose a challenge for future rational risk-based models of the size effect.

Finally, both sets of theories must contend with the fact that non-price based measures of size work at least as well as market-based size measures. These results revive the size anomaly, putting it on more equal footing with other anomalies such as value and momentum in terms of its efficacy and robustness, and dismiss several previous explanations for the size effect. Size should therefore be restored as one of the central cross-sectional empirical irregularities, presenting an even further challenge for asset pricing theory.

Om man får tro denna studien känns det eventuellt som aktiva fonder kan vara ett alternativ för att filtrera bort det värsta skräpet, som tex AMF Småbolag eller Svolder, alternativ ZPRV/ZPRX Small-cap Value om man vill ha globalt. Alternativ bygga en egen “index” portfölj med små kvalitetsbolag genom att använda Börsdata, vad tänker ni?