Ja, jag tror tyvärr det. Kolla gärna på detta avsnitt, det förklarar det ganska bra:

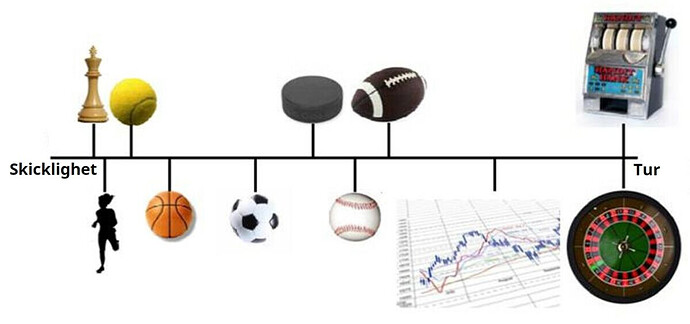

Där använder jag följande bild:

Vissa aktiviteter drar mer åt skicklighet och där får du betalt för att vara duktig. Visst finns det ett mått av tur, men det hänger ofta ihop med att man exponerar sig för många möjligheter och tränar hårt. I andra änden har du rena tur-baserade aktiviteter, hur mycket du än tränar så kommer inte skicklighet påverka utfallet.

Du kan även kolla intervjun med professor Paolo Sodini från Handelshögskolan i Stockholm i avsnitt 270

Här är ett klipp från transkriberingen:

So just think about this; this is a good company, and I should invest in it. Well, it depends on which price you buy.

If everyone knows it’s a good company, the company is going to be highly valued anyway, and this will not give you such a high return. Maybe you are paying too much because everyone thinks it’s a good company but they are actually carried away. But also, some news that just came out publicly and maybe it’s not a full representation of the overall prospect of the company. So I think it’s a little bit how the industry is built and that is actually a problem.

Jan: One of the main issues is to try to differentiate luck from skill, for instance when you look at the historical performance of someone´s stock-picking. I have a faint memory that you said, when you visited us last time, that you need an obscene amount of time in order to be able to conclude something definitively.

Paolo: Exactly, the problem is that there is so much volatility in the market to really figure out what leverage you will receive from a specific investment or from the overall market even. It’s very challenging from a simple statistical point of view.

So there is one thing I think I told you, or what I tend to tell my students. Let’s look at the world index. Since it’s so diversified, it has the least volatility, and we are talking about fifteen percent or something like that. And when we take all the data we have, which is about 150 years of data, then we really can’t estimate how much the stock market gives you above the bond market.

We could place it anywhere between four and eight percent. And of course, I mean, the estimate is about six, five and a half, something like that.

But it’s not at all precise. In fact, I don’t know if it is four, if it is eight, and if you invest in your pension and receive four percent, you have one pension outcome. If you receive eight percent, you have a completely different pension outcome. So we are not talking peanuts here.

Now, let’s take a mutual fund manager, and let’s say that this person has the typical pension. This person has a lof of experience, has been out there for ten years. I’m going to try to see if this person can beat the benchmark at ten years.

There is a statistical fact that is a little bit shocking: If I would like to know how much stocks earn over bonds, it is between five and a half and 600 percent.

So I just want to have one percent bound around six percent. I need 3000 years of data with that volatility. So we would need to go back to Egyptian time. Of course, the stock market, first of all, didn’t exist back then. Second, it’s probably so that what happened in Egyptian time and Roman time isn´t representative of what is happening today. So you also have this tradeoff between the fact that the economy, the world, and our society changes dramatically and taking data that goes back a long time, maybe is not representative of what’s happening now.

So that’s a curse, but this allows people to quote very good performances that in fact we can’t really statistically say whether they are good or not. If statistically, I can’t really say whether the fund manager is good or bad, it is extremely difficult to distinguish a skill versus luck for this reason.

The next best thing is to explain that you have something really good in your hand. So you follow a strategy that is winning, that the reason as a class is going to do very well for whatever reason. Hence all the talking and all the discussions and the different products that we see in the retail industry and in the media.