Läste tidigare ikväll följande artikel av John Hussman. Det är galet mycket överkurs och vänder sig till professionella investerare, men den är väldigt intressant (när man läst den för tredje gången och fattat hans poänger).

Nu ska man ha i åtanke att han driver en fond och är lite av en perma-björn, men det förtar inte hans sjukt genomarbetade analyser.

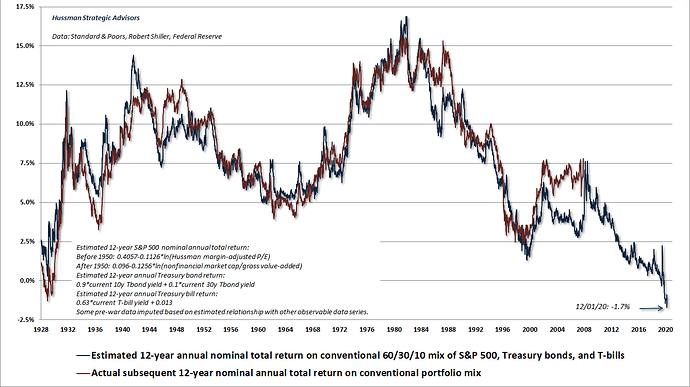

Förväntad avkastning de kommande 12 åren baserat på historik är -4.6 % per år

Investors have become so intolerant of the frying pan of zero interest rates that they’re now only too willing to launch themselves into the fire. As risk-aversion has abated, and investors look toward a post-pandemic future, speculation has now driven our estimate of prospective 12-year S&P 500 average annual nominal total returns to -3.6%.

Stock prices haven’t just priced in a recovery. They’re already beyond where they were before the pandemic . Indeed, we currently estimate that the average annual nominal total return of the S&P 500 is likely to lag the returns of Treasury bonds, by fully -4.6% during the coming 12-year period. So much for the notion of an “equity risk premium.”

Värdet av att ha kontanter i portföljen eller en tillgång som är likvid men avkastar 0 %

Given the choice of investing in a risky security, or holding cash in the hope of better opportunities, the ‘option value of cash’ is greatest when a) the expected return of the security is low, and b) the potential volatility of the security is high.

samt

All of this has enormous relevance for the current stock market. By our estimates, the likely return of the S&P 500 over the coming 12-year period is actually a loss of -3.5% annually. That alone actually makes zero-interest cash a competitive alternative, in my view.

But the case for cash (or our preference, hedged equity) is far more compelling, because the lowest prospective S&P 500 expected returns in history are also coupled with the potential for one of the deepest market losses on record over the completion of this cycle.

Han är ju inte jättepositiv till framtiden heller:

Yes, I know. A drawdown of 65-70% sounds insane and utterly preposterous, but the revulsion to that idea is largely due to pervasive speculative psychology, not historical evidence, cash flows, or fundamentals. From the standpoint of fundamentals, the most reliable set of valuation measures we’ve tested across a century of market cycles place current valuations at roughly 3.3 times the run-of-the-mill norms from which historically normal market returns have actually emerged.

Ja, lite tankespjärn så här på jullovet. ![]()

![]()

Som vi skrev om i en annan tråd så behöver inte allt vara svart eller vitt, för vissa personer ja, men i livet som stort går det inte att ha allt svart eller vitt!

Som vi skrev om i en annan tråd så behöver inte allt vara svart eller vitt, för vissa personer ja, men i livet som stort går det inte att ha allt svart eller vitt!