Morningstar släppte för ett tag sedan sin årliga rapport “Mind the Gap 2023”. Några höjdpunkter

- Snittinvesteraren förlorar ca 1.5 - 1.7% per år i snitt mot fonden hen investerar. Stämmer väl överens med de ca 20 - 40% som de flesta investerare förlorar mot index. Det går i linje med Dalbars årliga QAIB-rapport och t.ex. JP Morgans årliga rapporter.

Sammanfattning nedan, min fetstil:

Our annual study of dollar-weighted returns (also known as investor returns) finds investors earned about 6% per year on the average dollar they invested in mutual funds and exchange-traded funds over the trailing 10 years ended Dec. 31, 2022.

This is about 1.7 percentage points less than the total returns their fund investments generated over the same period. This shortfall, or gap, stems from poorly timed purchases and sales of fund shares, which cost investors roughly one fifth the return they would have earned if they had simply bought and held.

The 1.7-percentage-point gap between investor returns and total returns is more or less in line with the gaps we found for the four previous rolling 10-year periods. The persistent gap between the returns investors actually experience and reported total returns makes cash flow timing one of the most significant factors—along with investment costs and tax efficiency—that can influence an investor’s end results.

Our research imparts a few lessons on how investors can avoid these gaps and capture more of their fund investments’ total returns by emphasizing fewer widely diversified funds, automating tasks like rebalancing, avoiding narrower or highly volatile funds, and favoring simpler approaches they can stick with rather than theoretically optimal strategies they can’t.

samt

This annual return gap is in line with the gaps we measured over the four previous rolling 10-year

periods, which ranged from 1.5 to 1.7 percentage points per yearInvestors in allocation funds, which combine stocks, bonds, and other asset classes, have continued to fare best, as these funds had the narrowest return gap of any category group.

The more volatile a fund, the more trouble investors tended to have capturing its full return. Funds with higher levels of volatility generally experienced wider return gaps

och “Vad kan man göra åt saken”

What can investors do to earn more of their fund investments’ total returns? Here are a few lessons to be drawn from our findings: Hold fewer, more widely diversified funds and automate

Time and again, we have found that investors in allocation funds capture a greater share of the funds’ total returns. Why? They are designed to be all-in-one holdings given they span multiple asset classes and rebalance on a regular basis, sparing investors from having to do much maintenance.

Allocation funds also help mitigate the risk of mental-accounting mistakes that investors are prone to, such as buying more of a high-performing stand-alone strategy and selling a lagging one when they ought to do the opposite. Allocation funds combine these separate strategies to form a cohesive whole, and thus the performance divergences that otherwise might push investors’ buttons are largely unseen. Avoid narrow or highly volatile funds.

Another clear finding from the study is that investors have struggled to successfully use narrowly focused or highly volatile funds. These types of funds—whether they were nontraditional equity offerings or those that were among the most volatile in their category group—saw some of the heftiest return gaps that we measured. Most investors would likely be better off keeping it simple in ways that emphasize wide diversification and low costs, which means steering clear of strategies like these. Keep it simple.

The evidence suggests that investors enjoyed greater success when they didn’t make the perfect the enemy of the good, instead favoring simpler solutions like allocation funds. Interestingly, we found larger gaps in areas and styles for which there is robust academic support, like tilting to value, smaller-company stocks, or emerging markets, suggesting that the added volatility these strategies entail cost investors any excess return they might have earned and then some. The same held for more- exotic strategies that on paper might push a portfolio closer to the efficient frontier but in real life confound investors into costly mistakes. Don’t assume that penny-pinching or indexing will necessarily translate to superior dollar-weighted returns.

While it’s laudable to keep costs to a minimum and invest passively through diversified index funds or ETFs, we didn’t find that these practices necessarily prevented wide gaps from forming between these funds’ dollar-weighted and total returns. This suggests that timing issues plagued even those who’d emphasized low costs and a passive approach. Some of this owes to circumstance—that is, investors allocating capital to low-cost passive funds in a recurring way as part of a long-term strategy, only to see returns deteriorate. But it’s likely that some owes to other preventable factors, such as investors’ propensity to chase returns.

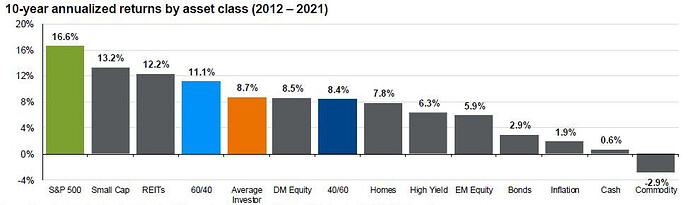

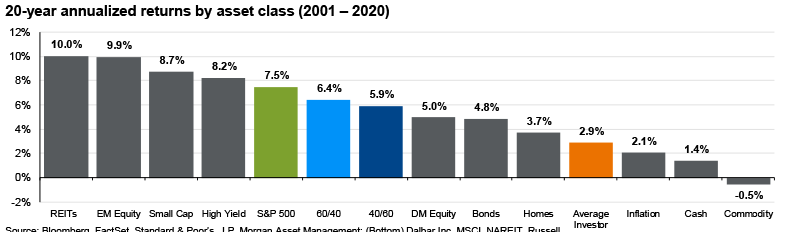

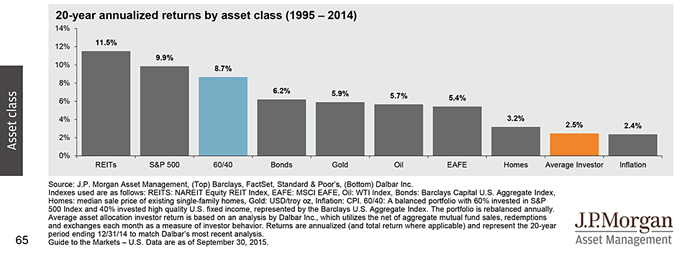

JP Morgan: Guide to the markets

Från deras “” från några olika 10-års perioder.

10 års rullande - 2012 - 2021

20 års rullande - 2001-2020

20 års rullande - 1995 - 2014

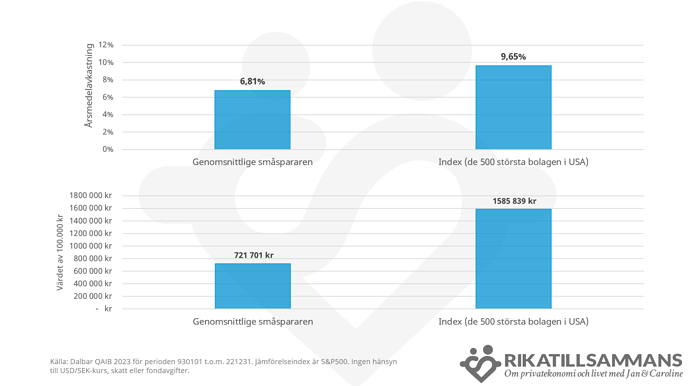

Avanzianen vs index

Detta är sämst data då den inte är vetenskaplig, utan en jämförelse av snittinvesterare så som Avanza presenterar det i “Mitt år” och Stockholmsindex samt tar t.ex. inte hänsyn till om någon inte har 100% aktier. Men skillnaden är mindre än man tror de åren jag har fått data.

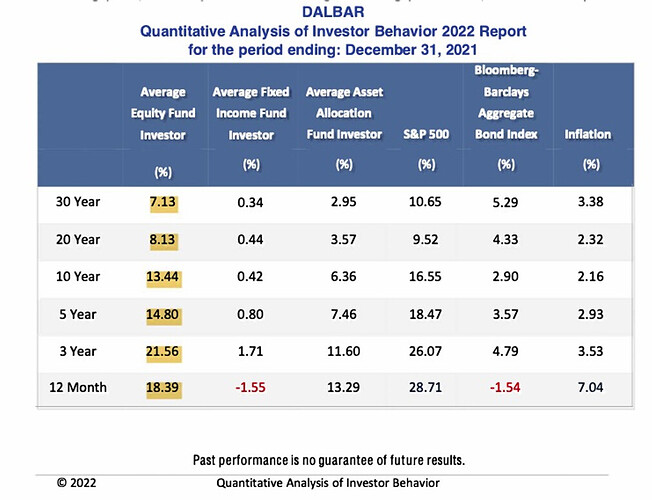

Dalbars QAIB-rapport

Varje år släpper Dalbar en QAIB-rapport som jämför snittinvesteraren med index. Per 31 december 2022 och rullande 30 år var skillnaden:

Om man vill titta på fler perioder så är nedan per 2021-12-31:

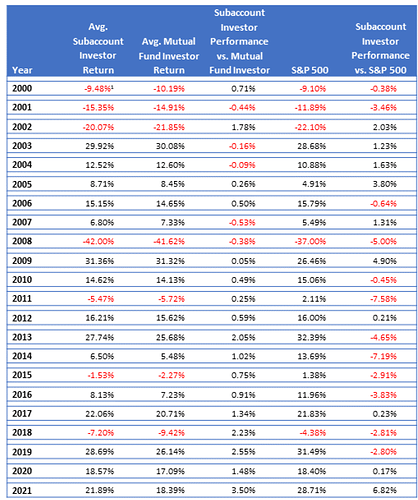

Eller lite historisk data: